Gross annual income calculator

You can change the calculation by saving a new Main income. Net income 1 - deduction rate For example if your net income was 29750 and you know your tax rate is 15 you can complete the equation as follows.

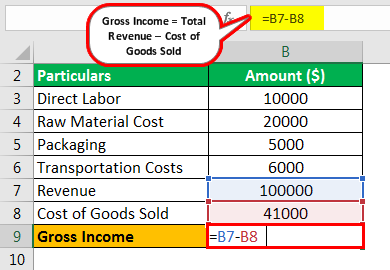

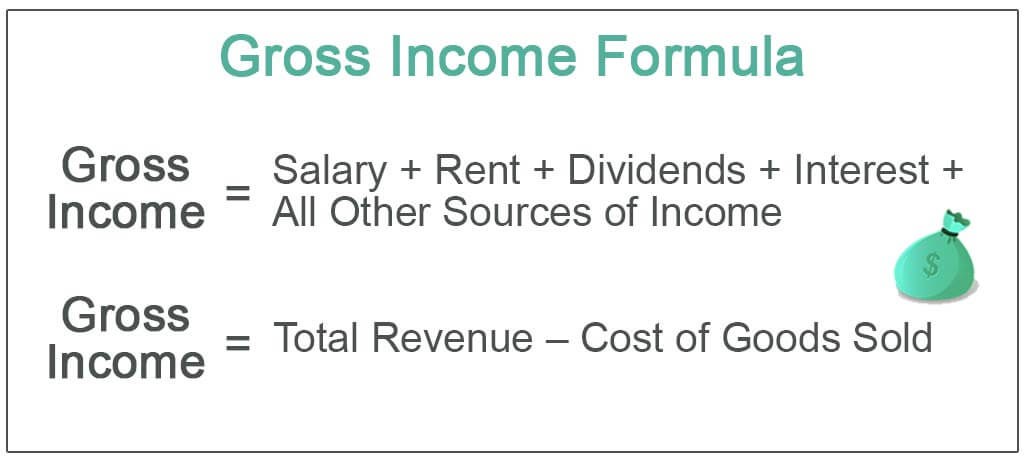

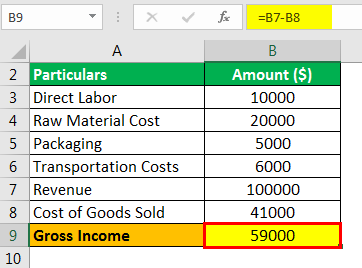

Gross Income Formula Step By Step Calculations

The compensation of employees can be presented in various forms.

. The calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax liability of an individual. KiwiSaver knumber optional The percentage you contribute towards KiwiSaver. Number of hours worked each week x hourly rate x 52 annual gross income.

Here are the steps to using this. The default assumes you have opted out. You can calculate your AGI for the year using the following formula.

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Before the net annual income can be estimated calculating the gross annual income is the necessary first step. Effective Income Tax Rate.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. If you are unsure how to calculate gross income per year use the formula. In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work.

Gross income the sum of all the money you earn in a year. Your average tax rate is 293 and your marginal tax rate is 438. You may use an alternate equation to calculate your AGI.

Firstly calculate the gross income under all the 5 heads of income ie. Simply enter your annual salary and click calculate or switch to the advanced tax calculator to review employers national insurance payments income tax deductions and PAYE tax commitments for Scotland. The PAYE Calculator will auto calculate your saved Main gross salary.

Salary house property capital gains business or profession and. Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example. Enter the gross hourly earnings into the first field.

This is the income tax you will have to pay as a percentage of your gross income. To convert from your net annual income to your gross annual income you can use this simple formula. To use this annual income calculator you will need to know three values.

It can be any hourly weekly or annual before tax income. Sara works an average of 37 hours per week and takes two weeks off per year. AGI gross income adjustments to income.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Important Note on Calculator.

That means that your net pay will be 36763 per year or 3064 per month. You can calculate your take home pay based on your gross income PAYE NI and tax for 202223. Assume that Sally earns 2500 per hour at her job.

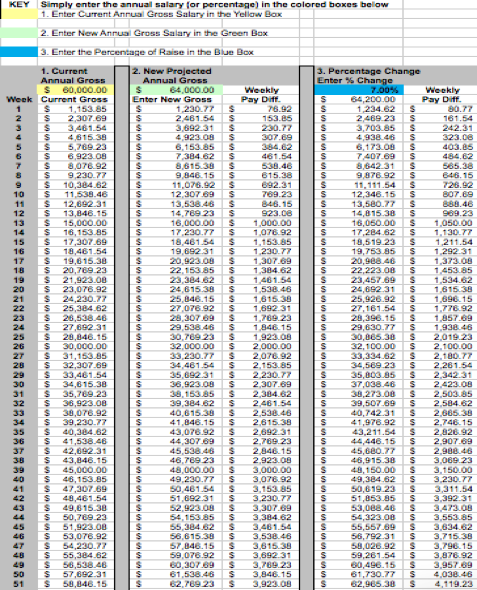

The fourth field will show your gross annual earnings. The calculator calculates gross annual income by using the first four fields. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

How to Use the Annual Income Calculator. Example of Annual Income Calculator. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

The unadjusted results ignore the holidays. 29750 1 - 015 29750 085 35000. If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237.

How to Calculate Annual Income. You may alter this number if you work fewer weeks in a year. Lets calculate an example together.

Lets work through how to calculate the yearly figure by using a simple example. Your hourly wage hours worked per week and the amount of paid time off per year. Your gross income is a measure that includes all money property and the value of services received that the IRS considers taxable income.

From the perspective of an individual worker gross income is the annual compensation before taxes and other deductions ie. 32000 21000 53000 Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses. This yearly salary calculator will calculate your gross annual income.

The 52 addresses the number of weeks you work consistently in a year. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. The top line revenue of the employee.

All other pay frequency inputs are assumed to be holidays and vacation days adjusted values.

Gross Income Formula Step By Step Calculations

Annual Income Calculator Discount 52 Off Www Wtashows Com

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Annual Salary Calculator Hotsell 54 Off Www Wtashows Com

Annual Income Formula And Gross Earnings Calculator Excel Template

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

4 Ways To Calculate Annual Salary Wikihow

How To Calculate Gross Income Per Month

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Annual Income Calculator

Gross Income Formula Step By Step Calculations

Annual Income Calculator Deals 57 Off Www Wtashows Com

Monthly Income Calculator Clearance 53 Off Www Wtashows Com

Gross Income Formula Step By Step Calculations

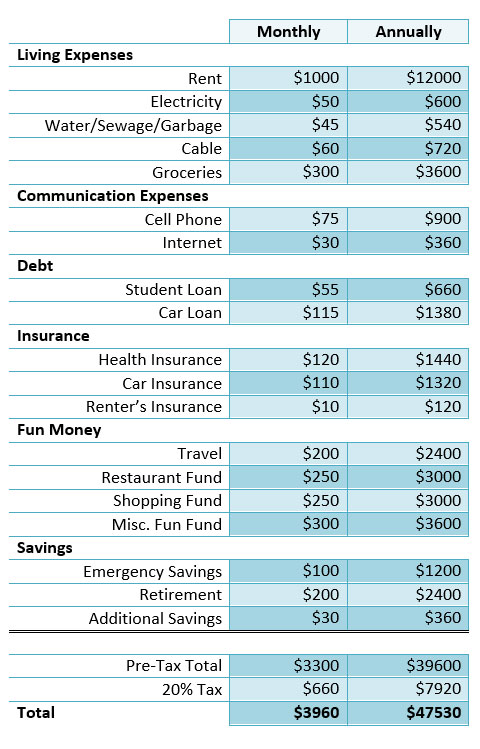

How To Calculate How Much You Need To Earn